nebraska sales tax rate by city

Ad Keep up with changing tax laws. The base state sales tax rate in Nebraska is 55.

2021 State Corporate Tax Rates And Brackets Tax Foundation

For other states see our list of nationwide sales tax rate changes.

. Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update. The Nebraska NE state sales tax rate is currently 55. What is the sales tax rate in Nebraska City Nebraska.

Annual Sales Tax Summary 1967-2021 This table shows an annual summary of the state net taxable sales and sales tax for other than motor vehicles motor vehicles a combined state. Nebraska has a 55 statewide sales tax rate but also has 337 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0832. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

The Nebraska City Nebraska sales tax is 750 consisting of 550 Nebraska state sales tax and 200 Nebraska City local sales taxesThe local sales tax consists of a 200 city sales. Beatrice NE Sales Tax. See current and past notices about changes to city and county sales tax rates.

Nebraska and Local Sales and Use Tax Return If applicable complete Schedule I. While many other states allow counties and other localities to collect a local option sales tax. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Nebraska has 149 cities counties and special districts that collect a local sales tax in addition to the Nebraska state sales taxClick any locality for a full breakdown of local property taxes or. Get the Avalara Tax Changes Midyear Update today. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0832 for a total of.

In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. Counties and cities in Nebraska are allowed to charge an additional local sales tax on. The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax.

Ad Keep up with changing tax laws. 30 rows City Total Sales Tax Rate. Tax Rate Charts show how much sales tax is due based on the amount of a sale.

Other cities with high sales tax rates include Omaha 65 Lincoln 6 Grand Island 6 and Kearney 6. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The minimum combined 2022 sales tax rate for Nebraska City Nebraska is.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. While many other states allow counties and other localities to collect a local option sales tax.

Falls City 15 70 07 79-182 16655 Farnam 10 65 065 143-183 16725 Fordyce 10 65 065 255-187 17110 Fort Calhoun 15 70 07 229-188 17145 Franklin. Raised from 6 to 65. Find your Nebraska combined state.

Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update. The Nebraska state sales and use tax rate is 55. The Nebraska City Nebraska sales tax is 550 the same as the Nebraska state sales tax.

Nebraska Sales Tax Rate Finder Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. Paper filers mail this return and payment to. Alliance NE Sales Tax Rate.

Complete Edit or Print Tax Forms Instantly. 536 rows Nebraska has state sales tax of 55 and allows local governments to collect a. Ad Access Tax Forms.

The highest sales tax rate in the state is 7 in Hastings. This is the total of state county and city sales tax rates. The Nebraska state sales and use tax rate is 55 055.

Get the Avalara Tax Changes Midyear Update today. To electronically file and pay your taxes.

Nebraska Tax Rates Rankings Nebraska State Taxes Tax Foundation

Pennsylvania Sales Tax Guide For Businesses

Bottle Racket Illinois High Alcohol Taxes Blow Up Cost Of Independence Day Celebrations

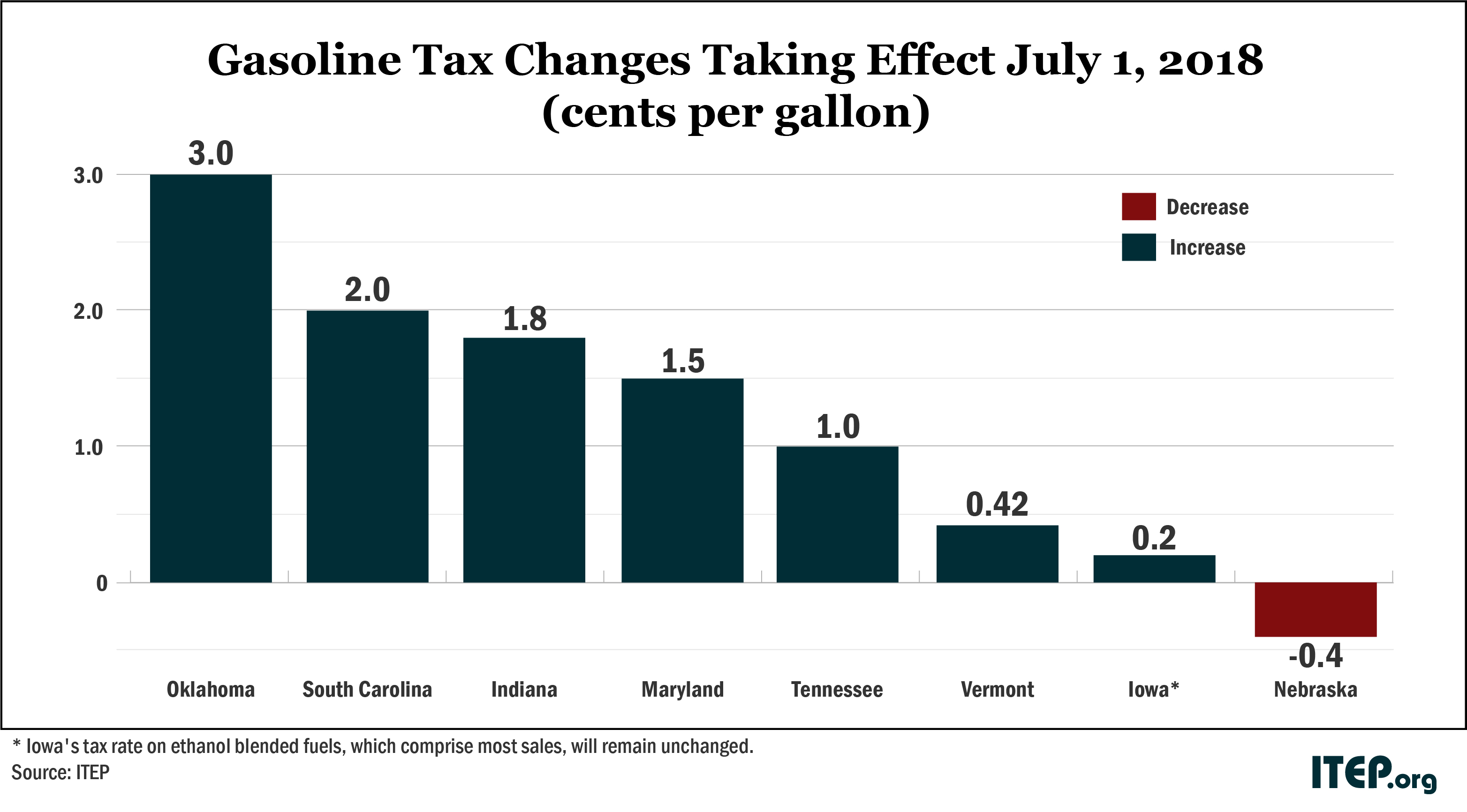

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

States With The Highest Lowest Tax Rates

Taxes And Spending In Nebraska

50 Years Ago Nebraskans Aroused To The Point Of Fury Over Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Sales Tax On Grocery Items Taxjar

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Tennessee 2022 Sales Tax Calculator Rate Lookup Tool Avalara

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

Kansas Sales Tax Rates By City County 2022