sales tax calculator austin texas

The Texas sales tax rate is currently. Real property tax on median home.

Managing Your Cash Flow To Stay In Business Long Term Scoresmallbiz Https Greatercincinnati Score Org Event Managing You Investing Filing Taxes Tax Attorney

That means that your net pay will be 45705 per year or 3809 per month.

. The current total local sales tax rate in Austin TX is. How to use Austin Sales Tax Calculator. You can see the total tax percentages of localities in the buttons.

Sales Tax State Local Sales Tax on Food. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. If this rate has been updated locally please contact us and we will update the sales tax rate for Austin Texas.

TX Sales Tax Rate. Texas are 125 cheaper than Austin Texas. How You Can Affect Your Texas Paycheck.

Check your city tax rate from here Thats it you can now get the tax amount as well as the final amount which includes the tax too Method to calculate Austin sales tax in 2021. The base sales tax in Texas is 625. Avalon TX Sales Tax Rate.

2022 Cost of Living Calculator for Taxes. For additional information see our Call Tips and Peak Schedule webpage. Texas has a 625 statewide sales tax rate but also has 981 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1681.

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. This is the total of state county and city sales tax rates. Sales Tax Calculator Austin Texas.

There is no applicable county tax. How much is sales tax in Austin in Texas. The Austin Sales Tax is collected by the merchant on all qualifying sales made within Austin.

The 825 sales tax rate in Austin consists of 625 Texas state sales tax 1 Austin tax and 1 Special tax. The County sales tax rate is. Before-tax price sale tax rate and final or after-tax price.

54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Austin Texas and College Station Texas. Austin collects the maximum legal local sales tax.

Sales Tax Rate s c l sr. This is the total of state county and city sales tax rates. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Austin TX.

Austin TX Sales Tax Rate. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The average cumulative sales tax rate between all of them is 708.

The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Austin local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. You can calculate Sales Tax manually using the formula or use the Austin Sales Tax Calculator or compare Sales Tax between different locations within Texas using the Texas State Sales Tax Comparison Calculator. 5 rows Sales Tax Summary.

US Sales Tax calculator Texas Austin. So your big Texas paycheck may take a hit when your property taxes come due. Choose the Sales Tax Rate from the drop-down list.

The sales tax rate for Austin was updated for the 2020 tax year this is the current sales tax rate we are using in the Austin Texas Sales Tax Comparison Calculator for 202223. Avoca TX Sales Tax Rate. Austin TX 78744 512 389-4800 800 792-1112 TPW Foundation Official Non-Profit Partner.

Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales. 4 rows Austin. Austwell TX Sales Tax Rate.

Vermont has a 6 general sales tax but an. In Texas prescription medicine and food seeds are exempt from taxation. Augusta TX Sales Tax Rate.

Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara. For tax rates in other cities see Texas sales taxes by city and county. The average cumulative sales tax rate in Austin Texas is 825.

Enter your Amount in the respected text field. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Texas local counties cities and special taxation districts. The Austin sales tax rate is.

Avery TX Sales Tax Rate. Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was purchased in another state. Sales tax in Austin Texas is currently 825.

BoatMotor Sales Use and New Resident Tax Calculator. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself. The minimum combined 2022 sales tax rate for Austin Texas is.

You can print a 825 sales tax table here. The most populous location in Austin County Texas is Sealy. And all states differ in their enforcement of sales tax.

While Texas statewide sales tax rate is a relatively modest 625. Choose city or other locality from Austin below for local Sales Tax calculation. Use this calculator with the following forms.

Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance. Axtell TX Sales Tax Rate. Aurora TX Sales Tax Rate.

VesselBoat Application PWD 143 Outboard Motor Application PWD 144. The most populous zip code in Austin County Texas is. Austonio TX Sales Tax Rate.

625 percent of sales price minus any trade-in allowance. That includes overtime bonuses commissions awards prizes and retroactive salary increases. As far as other cities towns and locations go the place with the highest sales tax rate is San Felipe and the place with the lowest sales tax rate is Bellville.

Cost of Living Indexes. If you want to boost your paycheck rather than find tax-advantaged deductions from it you can seek what are called supplemental wages. Texas Sales Tax.

Avinger TX Sales Tax Rate.

Fix Your Instagram Feed On Squarespace Squarespace Web Design By Christy Price Squarespace Web Design Squarespace Instagram Feed

Sales Taxes In The United States Wikiwand

Automatically Calculate Sales Tax In Squarespace Squarespace Web Design By Christy Price Squarespace Squarespace Web Design Web Design

Sales Taxes In The United States Wikiwand

State Corporate Income Tax Rates And Brackets Tax Foundation

County Surcharge On General Excise And Use Tax Department Of Taxation

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

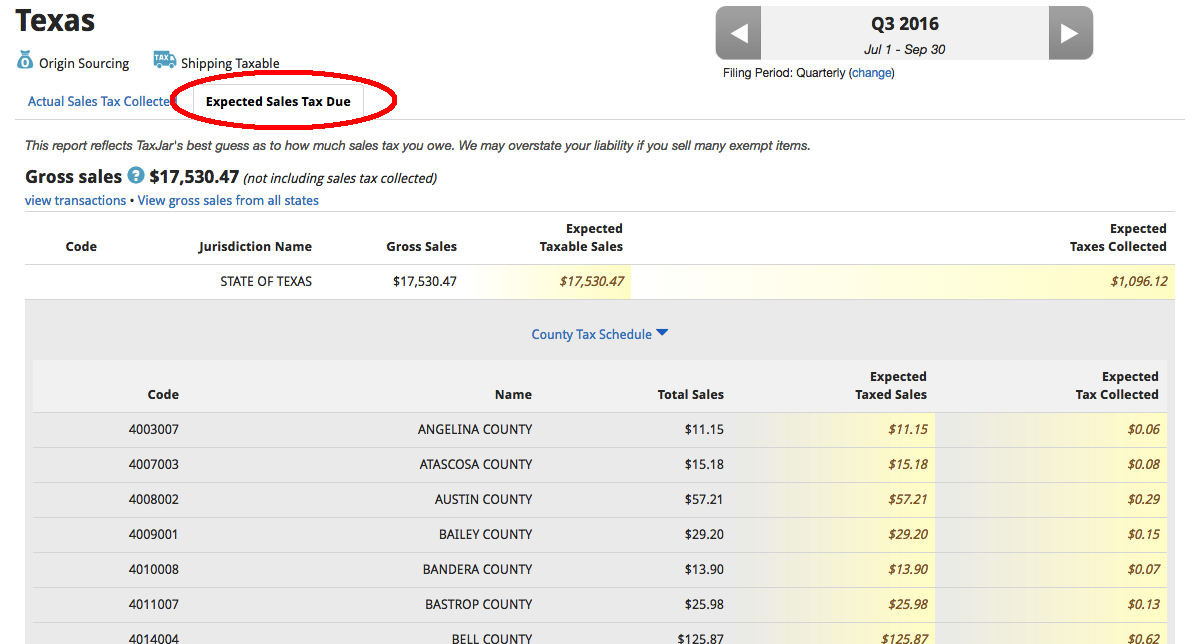

Some Texas Online Sellers Receive Alarming Sales Tax Penalty Notification Taxjar

H R Block Tax Calculator Services

H R Block Tax Calculator Services

How To Charge Sales Tax Vat With Samcart Samcart

Mortgage Calculator Mortgage Loan Calculator Screenshot Calculate Your Monthly M Mortgage Amortization Calculator Mortgage Loan Calculator Online Mortgage

Texas Sales Tax Guide And Calculator 2022 Taxjar

How To Find Original Price Tax 1 Youtube

Texas Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikiwand

Texas Income Tax Calculator Smartasset